Is Yahoo! finally a better deal than Google??!!

"what goes up, must come down".

Issac Newton certainly knew this adage all too well when he developed his scientific theory of gravity (law). Certainly if Issac Newton were alive today, he would surely be talking about the stock market and the stocks that compose it.

All I know is, no matter how high up a stock moves, its bound to eventually lose steam and settle back down. Which is exactly why I SOLD my GOOG (Google) not too long ago. It had a nice ride and I was lucky enough to go along with it, but enough is enough. There are better deals out there. Better value from competitors. In order to gain an edge, you have to think outside the box. You can't be biased towards one stock. Many who like GOOG will tell you they hate YHOO (Yahoo) and vice versa. This type of thinking is not productive and it leads you to miss excellent opportunites in similar stocks. You have to drop the word "hate" and "love" when it comes to stocks and start thinking about them more mutually in strengths and weaknesses, pros and cons. Thats more like it. This isn't a relationship. There isn't a love or hate component. And there shouldn't be. With that in mind, lets take a look at a stock that I believe is a better value than GOOG.

Chances are that you've seen it and used it before. Its good 'ol Yahoo! of course!

Yahoo! (YHOO) 3 month chart

Its not just the chart that's attractive. At 41.11, YHOO is a bargain compared to GOOG. I believe that regardless of P/E, YHOO may have an edge technically ( just my opinion).

YHOO trades under 50xEarnings (around 54 for Forward P/E). In that respect, YHOO is cheap in stock price.

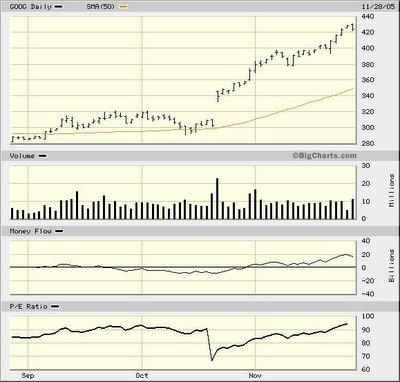

Google Inc (GOOG) 3 month chart

GOOG, on the other hand trades over 90x Earnings. Clearly more expensive than YHOO.

*CORRECTION: Forward P/E on GOOG is actually 49.9, while Forward P/E for YHOO is 54. The gap is narrowing, but still GOOG IS STILL slightly cheaper than YHOO.

So whats going on? Whats all this talk about GOOG being cheaper than YHOO (Cramer). That was over 100 points ago. That was then, this is now. Want a deal? My opinion is, go with the YHOO. Oh and check the accumulation and buying from mutual funds. I see 10,000-20,000 share block buys going on all day for YHOO. What about GOOG? 1000 share block buys if its lucky.

2 Comments:

I found your site a few days ago. You have some interesting picks using technicals. I have to say something about your goog valuation. You should use 06 estimates to value stocks now, in that case goog is undervalued. Most analyst say goog is going to earn about $9 dollars a share next year (very conservative) historically goog sells at 50x earnings.9*50=450, which means goog is almost fairly valued. But I (along with many other people) think that next year goog can do 10 a share or more, which would put it at $500. I dont think goog is down going up. I just wanted to point out that goog is not selling at 90x earnings. Anyways, good luck with your investing.

( I rencently sold all my goog calls, too much of a gain not to)

Dont hesitate to respond

Im in college just like you

Hey whats up Matthew,

Thanks for checking out my site and thanks for the comment!

Ahh yes, you are right about the GOOG valuation. I didn't use 2006 estimates. Thanks for pointing this out for me. So Forward P/E is roughly 50x earnings, I got it now!

Matt, I too believe that GOOG can go higher (even to 500), but with GOOG over 420 bucks a pop, YHOO is looking very attractive. The truth is, as the price continues to climb, it becomes increasingly more difficult to build a solid position, especially if you don't have that many funds to play with. Plus I am noticing very heavy institutional buying in YHOO by institutions (more so than GOOG at the moment). I also decided to sell my GOOG position for some a nice return. Out of any stocks that I've held, GOOG has been one of the most rewarding, so I can't hate on it!

So you go to school as well? Where do you go and what do you major in?

Later Matt!

Nick

Post a Comment

Subscribe to Post Comments [Atom]

<< Home